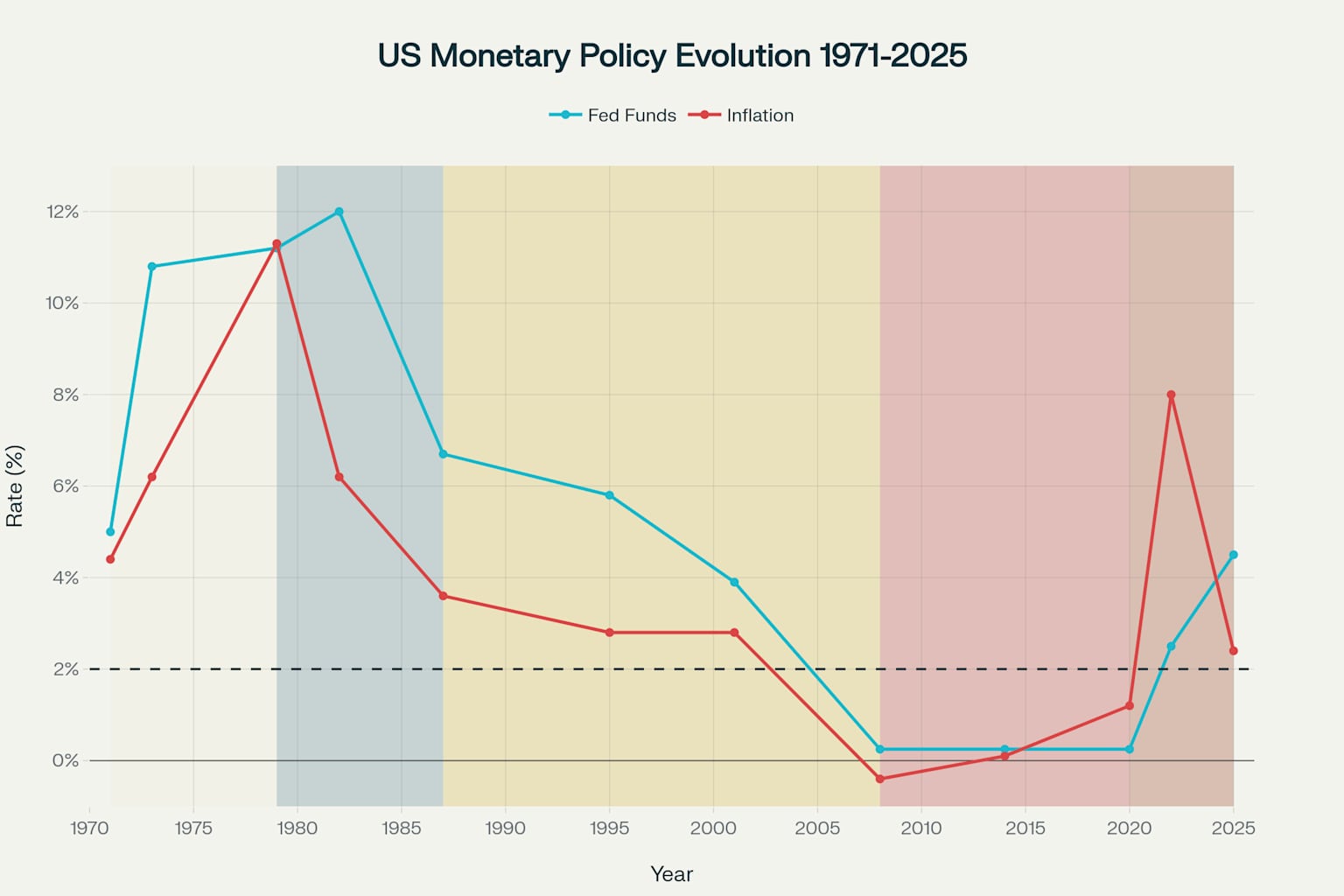

Evolution of US Monetary Policy

From the Nixon Shock to Present (1971-2025)

A comprehensive journey through five decades of Federal Reserve policy, key inflection points, and the evolution of central banking in the United States.

Historical Context: The Bretton Woods Era

Pre-1971: The Gold Standard System

- Fixed Exchange Rates: Currencies pegged to the US dollar

- Gold Convertibility: $35 per ounce fixed rate

- Limited Monetary Policy: Constrained by gold reserves

- International Stability: But growing structural imbalances

Growing Pressures by 1971:

Vietnam War spending creating fiscal deficits

Rising inflation undermining dollar confidence

International run on US gold reserves

Trade deficits weakening US position

The Nixon Shock (1971)

The Foundation of Modern Monetary Policy

Fed Chair: Arthur Burns (1970-1978)

"Accommodative policy during stagflation"

August 15, 1971: Historic Announcement

- End of gold convertibility ($35/ounce fixed rate)

- Wage and price controls implemented

- 10% import surcharge imposed

- Birth of the modern fiat money system

Impact & Significance:

Bretton Woods collapse marked the beginning of the fiat money era, giving the Federal Reserve unprecedented flexibility in monetary policy but also new challenges in maintaining price stability.

The Stagflation Crisis (1973-1979)

When Traditional Economics Failed

Perfect Storm of Factors:

- Oil Shocks: 1973 & 1979 oil crises

- Supply Disruptions: Food and energy price spikes

- Wage-Price Spiral: Expectations driving inflation

- Policy Confusion: Fed torn between goals

Keynesian Economics Challenged:

The Phillips Curve relationship between unemployment and inflation broke down. High inflation coexisted with high unemployment, something traditional economic theory said was impossible.

Key Lessons:

Demonstrated the limits of traditional monetary policy and the critical importance of inflation expectations management.

The Volcker Era (1979-1987)

Breaking the Back of Inflation

Fed Chair: Paul Volcker (1979-1987)

"Dramatic interest rate increases, monetarist approach"

The Volcker Shock (1979-1982):

- Aggressive Rate Hikes: Fed funds rate to 20%+

- Monetarist Focus: Targeting money supply growth

- Credibility First: Price stability over employment

- Political Courage: Withstood enormous pressure

Before (1979)

After (1987)

Legacy & Impact:

Established Fed credibility for price stability. Though it caused severe recessions (1981-82), it permanently changed inflation expectations and laid the groundwork for the Great Moderation.

The Greenspan Era (1987-2006)

The Great Moderation

Fed Chair: Alan Greenspan (1987-2006)

"Implicit inflation targeting, forward guidance, asset bubble response"

Characteristics of the Great Moderation:

Low, Stable Inflation

Consistent 2-3% inflation rates

Steady Growth

Reduced economic volatility

Implicit Targeting

~2% inflation goal (unofficial)

Forward Guidance

Clear communication strategy

Challenges Managed:

- 1987 Black Monday stock crash

- 1990-91 recession and S&L crisis

- Dot-com bubble and bust (2000-2001)

- 9/11 economic impact

Financial Crisis Response (2008)

Birth of Unconventional Monetary Policy

Fed Chair: Ben Bernanke (2006-2014)

"Quantitative easing, zero interest rate policy, forward guidance"

Unprecedented Policy Response:

New Monetary Policy Tools:

Quantitative Easing

Large-scale asset purchases

Forward Guidance

Explicit future policy commitments

Credit Facilities

Direct lending to markets

Balance Sheet Policy

Active portfolio management

Impact:

Prevented a repeat of the Great Depression, but fundamentally expanded the Fed's toolkit and role in financial markets.

Post-Crisis Era (2008-2020)

The New Normal

Ben Bernanke (2006-2014)

Crisis response and QE implementation

Janet Yellen (2014-2018)

Gradual normalization and employment focus

Characteristics of the New Normal:

Lower for Longer

Persistently low interest rates

Gradual Normalization

Slow, telegraphed rate increases

Balance Sheet Legacy

Large Fed balance sheet maintained

Enhanced Communication

Regular press conferences, projections

Recovery Achievements:

- Unemployment fell from 10% to 3.5% (2010-2019)

- Inflation remained below 2% target

- Financial system stability restored

- Gradual rate normalization (2015-2018)

COVID-19 & Recent Developments (2020-2025)

Testing Modern Monetary Policy

Fed Chair: Jerome Powell (2018-present)

"Flexible inflation targeting, COVID-19 response, financial stability focus"

2020 Pandemic Response:

- Emergency Rate Cuts: Fed funds to 0-0.25% (March 2020)

- Unlimited QE: "Whatever it takes" asset purchases

- New Facilities: Municipal bonds, corporate credit

- Coordination: Massive fiscal-monetary cooperation

The Return of Inflation (2021-2022):

Current Policy Framework & Tools

The Modern Fed's Arsenal

Traditional Tools (Pre-2008)

- Federal Funds Rate

- Discount Rate

- Reserve Requirements

- Open Market Operations

Unconventional Tools (Post-2008)

- Quantitative Easing (QE)

- Forward Guidance

- Yield Curve Control

- Balance Sheet Policies

Communication Tools

- FOMC Statements

- Press Conferences

- Economic Projections

- Meeting Minutes

The Fed's Dual Mandate:

Price Stability

2% inflation target (symmetric)

Maximum Employment

Full employment consistent with price stability

Current Status (May 2025):

Key Lessons & Future Outlook

Key Lessons from 54 Years:

1. Credibility is Everything

Volcker's era proved that central bank credibility for price stability is fundamental to effective monetary policy.

2. Flexibility in Tools is Essential

The 2008 crisis showed that unconventional tools become necessary when traditional policy reaches its limits.

3. Communication as Policy Tool

Forward guidance and clear communication have become as important as interest rate changes themselves.

4. Inflation Expectations Matter

Managing inflation expectations is often more important than current inflation levels.

Future Challenges:

🌡️ Climate Finance

Integration of climate risks into monetary policy framework

💱 Digital Currencies

Central Bank Digital Currencies (CBDCs) and crypto regulation

📊 Data Revolution

Big data and AI in monetary policy decision-making

🌍 Global Coordination

Managing spillovers in an interconnected world

Summary: The Evolution Continues

From Nixon Shock to Modern Fed (1971-2025)

The Transformation:

From (1971)

- Gold-constrained policy

- Limited tools

- Unclear objectives

- Poor communication

To (2025)

- Flexible inflation targeting

- Comprehensive toolkit

- Clear dual mandate

- Transparent communication

Looking Ahead:

The Federal Reserve has evolved from a constrained, crisis-reactive institution to a sophisticated, forward-looking central bank. As new challenges emerge—from digital currencies to climate change—the Fed's continued evolution will be critical to maintaining economic stability and prosperity.